The Little Girl That Brings Big Change

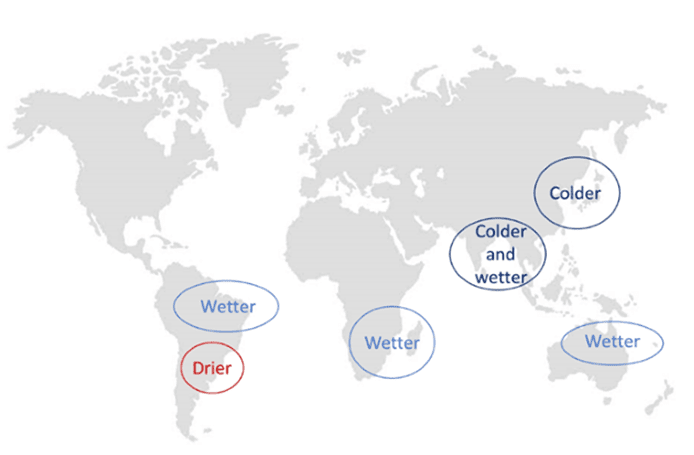

The World Meteorological Organization (WMO) defines La Niña (the little girl in Spanish) as “the large-scale cooling of the ocean surface temperatures in the central and eastern equatorial Pacific Ocean, coupled with changes in the tropical atmospheric circulation, namely winds, pressure and rainfall. It usually has the opposite impacts on weather and climate as El Niño, which is the warm phase of the so-called El Niño Southern Oscillation (ENSO).” La Niña can lead to significant weather disruptions increasing rainfall in some countries such as Australia, causing drought in other areas including South Brazil / North Argentina, and triggering colder winter temperatures in the Far East.

The last time a strong La Niña event developed was in 2010-2011 followed by a moderate episode in 2011-2012, and a weaker one in 2017-2018. According to the WMO, this year’s event should be a “moderate to strong” one and is expected to last until February 2021 before weakening in the spring of 2021.

Through these weather disruptions, La Niña can have a significant impact on the dry bulk market as extreme weather events can affect mining, shipping operations and agricultural production. In this report we take a look at the potential consequences of this year’s event and its impact on the dry bulk market.

1. Australia

LOWER COAL EXPORTS

Likelihood: Medium / High

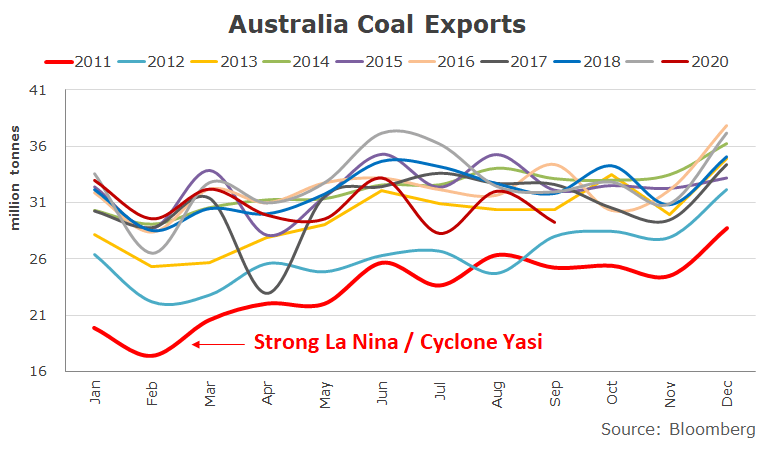

During the last strong La Niña event (in 2010/2011), Australia had seen higher-than-normal precipitation with 2010 and 2011 being the third and second wettest years on record for the country, and more numerous / more intense cyclones. Cyclone Yasi that occurred between end-January and early – February 2011 was one of the most violent recorded in Queensland, a coal-rich region, which had a very negative impact on coal exports from the country. La Niña had triggered a 13% fall in Q1 coal exports compared the previous year (versus a 5% increase year-on-year on average between 2012 and 2020). In the worst-case scenario, a similar drop in Q1 2021 would mean a 19 million tonne drop in coal exports compared to Q1 2020.

As a consequence the main impact we can expect from this year’s La Niña is lower coal exports from Australia during end Q4 2020 – Q1 2021.

DISRUPTIONS IN IRON ORE EXPORTS

Likelihood: Low / Medium

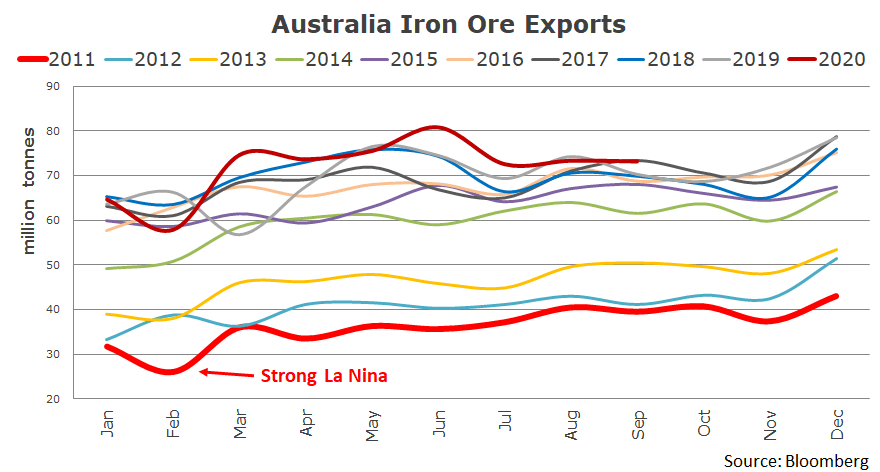

La Niña’s impact on Western Australia is much less significant than in Eastern Australia but in the event of a strong episode like in 2010/2011 we may also see above average rainfall in Western Australia which would disrupt shipping activity in the area and impact iron ore exports negatively. This was the case in 2011 for example when iron ore exports dropped considerably during the first two months of the year.

In 2011, iron ore exports fell by 1% in Q1 compared to the year prior, a relatively small drop but quite a weak year-on-year change compared to 9% year-on-year increases seen on average between 2012 and 2020. In the worst-case scenario, a similar drop in Q1 2021 would mean a loss of around 2 million tonnes compared to Q1 2020.

2. South America

POTENTIAL DELAYS IN GRAIN PLANTINGS AND LOWER HARVEST

Likelihood: Medium

Drought in Northern Argentina / Southern Brazil is delaying corn and soybean plantings and we have already seen Argentinean farmers favour late planting for corn (i.e. in December / January versus the usual September / October) meaning that the harvest and exports would be delayed by about three months as well. Brazil’s agricultural sector should be less impacted by La Niña although drier conditions in the south could also delay soybean and corn plantings.

The United States Department of Agriculture (USDA) has not downgraded its predictions for Brazil’s grain exports for the 2020/2021 period for the time being but it has already lowered its outlook for Argentina’s shipments by 2.0 million tonnes in its latest report citing “lingering impacts of drought”. Grain shipments from Argentina are currently predicted to be 84.1 million tonnes in the 2020/2021 period, which would be a three-year low.

DISRUPTIONS IN IRON ORE EXPORTS

Likeliness: Low / Medium

Another potential impact of La Niña is higher-than-normal rainfall in northern Brazil i.e. where Vale has its largest iron ore mines which is another source of concern for the miner : “For Vale, La Niña may mean heavier rains in northern Brazil, where the company operates its most profitable mines, and drier conditions — and less disruption risk — in the south” said Marcello Spinelli, head of iron ore, on a call with analysts in mid-November.

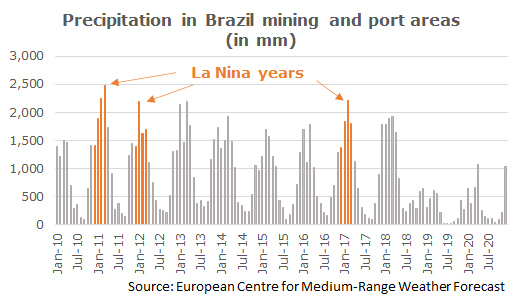

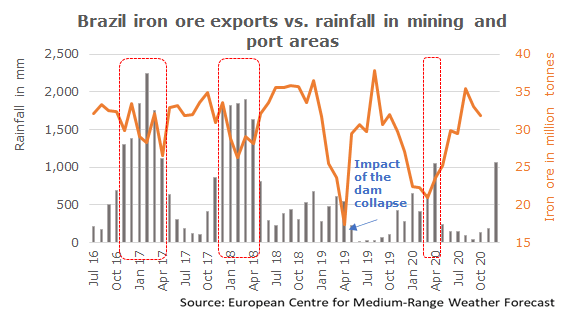

In 2011, rainfall had been particularly high in Brazil, reaching a peak in March 2011 with 2,500 mm of rainfall, the highest figure in the past ten years. Looking at the 2010-2020 period, rainfall has been 45% higher in La Niña years (compared with non-La Niña years) during the first quarter of the year.

According to The European Centre for Medium-Range Weather Forecasts, precipitation in Brazil’s key iron ore mining regions and port areas could be abundant in December particularly in Tubarao and Belo Horizonte where precipitation is predicted to be the strongest since March 2018 and up 145% compared to December last year. Wetter months coincide with less iron ore exports from Brazil (exports are around 10% less compared to months when precipitation is below 1,000 mm – basis data over the past ten years).

As a result, we can expect iron ore shipments from Brazil to be disrupted over the next few months.

3. Asia

COLDER WINTER TO BOOST COAL DEMAND

Likelihood: Medium

In South East Asia and the Far East, La Niña brings lower-than-normal temperatures during winter and higher rainfall in South East Asia.

According to the China Electricity Council, China could experience its most severe coal shortage since the fourth quarter of 2016 on tight supply (due to safety checks at domestic mines and coal import quotas) and higher coal demand partly due to colder temperatures during the winter attributable to La Niña. During the last La Niña episodes China’s electricity consumption had been firm, up 15% year-on-year in January – February 2011, up 19% year-on-year in January – February 2012, and up 7% year-on-year in January – February 2018, versus +6% on average in non-La Niña years. This year’s La Niña is expected to be stronger than in 2017-2018 meaning that we could see a boost in electricity consumption in the next few months. Higher power demand combined with tight coal supply and low stockpiles result in quite a compelling situation for coal imports into China although the impact might not be visible before Q1 2021 when new import quotas will be released unless the situation becomes urgent soon.

Cold snaps are not only expected in China as, according to the Japan Meteorology Agency, there is a 90% probability for Japan to be afffected by La Niña this winter which should translate into higher heating requirements. In India as well, temperatures are expected to be 2 to 3 degrees below average this winter.

Conclusion

Summary of the potential impacts of La Nina on the dry bulk market:

– Lower coal exports from Australia in Q1 2021

– Lower corn exports from Argentina during Q2 / Q3 2021

– Delayed planting / exports of Brazil and Argentina’s grains

– Disruptions to iron ore exports from Australia and Brazil during Q1 2021

+ Higher coal imports into South East Asia / Far East to cope with a colder winter

+ Disruptions to shipping activities in ports affected by heavy rainfall which could lead to delays and congestion.

Whilst the first four points would be negative news for the dry bulk market the last two could provide some support to rates particularly after the winter season when stockpiles of some commodities should be low. It is important to keep in mind that the strength and likeliness of the above consequences will depend on the scale of this year’s event.